CRAT or CRUT?

Selecting the RightTrust for Your Needs

One would think a simple either or decision would be the easiest to make, but as it turns out it is not always so straightforward. Take the choice of charitable remainder trust. Which works better for the client the annuity or one of the unitrust variations? Well, many prospective trust makers throw the choice back to their advisors, assuming that because there is a legal, financial planning, or accounting professional designation or degree that their advisors know what is best. As it turns out, thats not necessarily so since so many professionals now specialize and cant be expected to know all the problems associated with every tax planning situation, and few know anything about §664 split interest trusts. It is not reasonable to expect litigators and general practitioners to know about obscure tax rules any more than a psychiatrist would be competent to perform a kidney transplant. The possession of an MD, CFP, CPA, or JD designation only provides a framework for future knowledge and experience. What is most important is the practical application of that knowledge, and with charitable remainder trusts, there are precious few professionals who have ever seen one, much less understand them. As an example of the compartmentalization found among professionals, examine the planning that went into former President and Mrs. Clintons 1997 tax returns. Arguably, while theClintonshave access to lots of qualified counsel and even possess law degrees themselves, they still made serious blunders in their charitable and estate planning. If the first family cannot get it right, it should come as no shock that the majority of clients will not get it right either.

TheClintonspaid $291,755 in federal income taxes over the two years. But they could have paid $167,532 less by having royalties from It Takes a Village, Mrs. Clinton’s book about child rearing, sent directly from the publisher to a charitable fund instead of taking the money as income, paying taxes and giving away the difference. The charities would have come out ahead, too, collecting 22 percent more than the $840,000 they received.

It Takes a President to Overpay the IRS, New York Times,April 19, 1998

For most planners who dont specialize in charitable planning, their assumption that a CRAT is best for old folks and a CRUT is best for younger donors isnt necessarily the best way to make a decision about a trust thats irrevocable. This is especially true when the timeline of the CRT, something with which a donor must deal for years, is considered. Disagreements among advisors often pop up over investments inside a CRT since few financial advisors really understand the fiduciary accounting peculiarities of investing for a tax-exempt CRT. Because a charitable trust invests over a long time horizon, and the trust does not usually pay income tax on its growth or income, chasing returns and reacting day to day is not the style of investing that works best for the CRT. Add to the long term view the very real concern about avoiding unrelated business income that may be unintentionally created when a broker uses a margin account, acquires partnerships or other working interests that expose the trust to toxic income that loses the CRT its tax-exempt status.

A well drafted CRUT allows, even encourages, additional contributions; however, it is not an option in the annuity trust. Trustees need to properly fund the CRAT and be extra cautious to ensure that it is just one straightforward transaction and not in bits and pieces over a period of days. With a charitable remainder annuity trust (CRAT), the payout is irrevocably set in a fixed dollar amount at the inception of the trust, and this rigidity creates several potential problems for trustees managing the trust and its investments.

Which trusts work best? Sometimes knowing which trust will not work is a good place to start. For example, if a donor contributes cash or publicly traded stock, that is a workable solution, but if undeveloped land goes into to a CRAT, the downside risks are numerous.

- Will the asset produce enough income to meet the required income distributions? A CRAT may not defer required distributions and being illiquid is not an excuse.

- If the asset is not an income-producing asset, is it readily marketable to make the required distributions?

- If the CRAT does not have enough liquidity to meet the obligations of the trust, is the asset easily partitioned in order that the income beneficiary can receive an in-kind distribution? As an added insult, those in-kind distributions typically trigger capital gains tax liabilities, so the beneficiary receives his or her land back and has a tax bill to boot. That is a recipe for an unhappy client advisor relationship.

- Was the contribution of the asset matched with enough additional cash to pay insurance, property taxes, maintenance, marketing, and operating expenses? Remember, there can only be one contribution in a CRAT, so any cash transfer has to occur simultaneously with the transfer of the real estate deed.

- Generally speaking, a CRAT is a better tool for a donor unconcerned with eroding purchasing power, and it is typically used for clients with little tolerance for volatility and short term needs, i.e., less than ten years, otherwise inflationary pressures diminish the value of the income distributions.

- The minimum annuity paid at least annually must be at 5%, but cannot exceed 50% of the initial fair market value of the assets contributed to the trust. In most cases to prevent trust exhaustion, a CRAT paying out more than 6.5% is a concern.

- After the Taxpayer Relief Act of 1997 passed, the charity’s calculated remainder interest must be worth at least 10% of the value initially transferred to the trust. This severely restricts young individuals from having a life income interest in any CRT, and restricts payouts to lower levels for many trusts, especially if there are more than two income beneficiaries.

- Because there is a very real possibility of a CRAT collapse in a poor investment environment, these trusts must also meet a 5% probability test [Rev Rul 77-374]. If the trust fund has a greater than 5% chance that it will exhaust before the trust terminates and passes to the charity, then the trust will not produce an income tax deduction or qualify as a CRT.

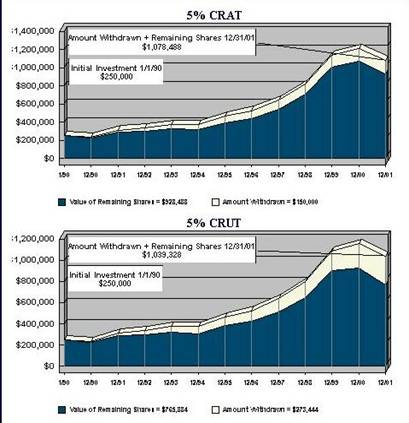

CRAT vs. CRUT invested in a growth mutual fund 1/1/19901/1/2002

|

Too many trustees take an ultra- conservative and shortsighted investment approach to preserve principal. However, prudent investment management is important if the income distributions are going to be tax efficient and the remainder value is to appreciate for the benefit of the charitable beneficiary. As an example of a well balanced equity approach, an annuity trust (CRAT) established on January 1, 1990 and funded with $250,000 that purchased diversified GFAA shares (after fees) would produce significant gains, even with the fixed dollar annual income distributions of $12,500 (5% of the initial value) made through the end of the trust period. While this specific trust is historically accurate in depicting annual returns even through several real market corrections, there is no guarantee of similar performance in the future; however, this particular fund has produced a trust remainder value of $928,488 as of12/31/2001

Using exactly the same investment vehicle and historical time horizon as the CRAT above, a 5% charitable remainder unitrust (CRUT) that pays a fixed percentage of the trust (annually revalued, so the payouts vary with the trusts investment performance), yet it still produces a significant return of $765,884 for the remainder beneficiary and the income interest is enhanced to offset the effects of inflation. A variable payout CRUT takes a percentage of a well-invested and diversified trust and increases in value. The CRUT in the example produced $273,444 of aggregated income over the twelve year period. Compared to the CRATs income payments of just $150,000, it should be obvious that the variable payout unitrust offers more opportunity for growth if the investment performs properly. Besides having a greater opportunity for an improved income stream, an equity based trust investment tends to produce more tier two (realized capital gains) income. Remember, realized gain taxed at the more efficient 20% rate leaving the income beneficiary with more spendable income, rather than being penalized at the highest marginal ordinary federal rate of up to 38.6%.

|

|

Select Appropriate Charitable Remainder Trust |

|

|

Which CRT Works Best? |

|

|

§ 644 Trust Options |

CRAT |

SCRUT |

FLIPCRUT |

NIMCRUT |

|

Is Current Income Needed? |

|

|

Y** |

Y*** |

|

Spigot Income or Deferral Strategy Allowed? |

|

|

Y** |

Y*** |

|

Contribution of Hard-to-value Illiquid Assets |

|

N/Y |

|

|

|

Multiple Contributions Allowed |

|

|

|

|

|

Fixed and Secure Income Desired |

|

N* |

N* |

N* |

|

Easy to Understand |

|

|

|

|

|

Preferred for Younger Income Beneficiary |

|

|

|

|

|

Flexible |

|

|

|

|

|

* Depends on payout rates that are lower than CRT investment portfolios performance |

|

|

** Depends on FLIP triggering event |

*** Depends on underlying assets inside CRT |

CONTACT US FOR A FREE PRELIMINARY CASE STUDY FOR YOUR OWN CRT SCENARIO or try your own at Donor Direct. Please note — there’s much more to estate and charitable planning than simply running software calculations, but it does give you a chance to see how the calculations affect some of the design considerations. This is not “do it yourself brain surgery”. Knowing when a CRUT is superior to a CRAT or which type of CRT is best used with which assets and what investments “poison the trust” is critical. Although it may be counter-intuitive, sometimes a lower payout CRUT makes more sense and pays more total income to beneficiaries. Why? When should you use a CLUT vs. CLAT and what are the traps found in each lead trust. Which tools work best in which planning scenarios? Check with our office for solutions to this alphabet soup of planned giving tools.

CONTACT US FOR A FREE PRELIMINARY CASE STUDY FOR YOUR OWN CRT SCENARIO or try your own at Donor Direct. Please note — there’s much more to estate and charitable planning than simply running software calculations, but it does give you a chance to see how the calculations affect some of the design considerations. This is not “do it yourself brain surgery”. Knowing when a CRUT is superior to a CRAT or which type of CRT is best used with which assets and what investments “poison the trust” is critical. Although it may be counter-intuitive, sometimes a lower payout CRUT makes more sense and pays more total income to beneficiaries. Why? When should you use a CLUT vs. CLAT and what are the traps found in each lead trust. Which tools work best in which planning scenarios? Check with our office for solutions to this alphabet soup of planned giving tools.