Nothing happens around here until someone sells something

Malpractice Issues XV

Nothing happens around here until someone sells something.

Unfortunately, there are still financial services companies pitching charitable trusts like loaves of bread, commodities sold to consumers who depend on their advisors for objective financial advice. Until advisors move from a commodity selling mentality to a values based, client-oriented consulting practice where all of the financial and estate planning tools are used in an integrated process, they run the chance of offering limited choices and potential harm to their clients. Add to that mixture the competing multi-disciplinary planning team approach pushed by law and accounting firms offering financial products and services, the traditional insurance and brokerage community may soon be on the outside looking in. While there is nothing wrong with an insurance agent selling a risk management product like an insurance policy or deferred annuity, not all estate planning clients need those products. This necessitates a change in business practices, because avoiding clients with a desire to establish a charitable estate plan simply because neither a life insurance policy nor annuity sale will occur is extremely short sighted. Worse yet, brokers border on the unethical when they steer clients away from advisors who can implement other necessary aspects of a plan simply because they will not generate commissionable sales.

What avoidable problems are charitable trust planners experiencing today? Too many disgruntled trust creators were lead to believe their trust investments would continue to outperform the market. With the prolonged bear market in recent years, trust makers have learned that CRUT income beneficiaries may actually receive declining payments instead of optimistically forecast increasing payouts. Too high payouts that eroded the value of the trusts principal and with less money at work, the trust may not recover enough financial strength to be useful over the income beneficiarys life expectancy. While the 10% remainder rule introduced in 1997 precluded a life payout CRT for young donors, historically low §7520 rates may further derail many annuity trusts (CRAT) and gift annuities (CGA). These and many other errors created by over-enthusiastic product sellers have cast an unappealing light on legitimate charitable planning, which otherwise offers truly motivated clients a great opportunity to create tax efficient philanthropy.

Many advisors have been to marketing seminars and were issued financial hammers, and everything begins to look like nails. Unfortunately, quite a few insurance and mutual fund companies consistently promote the CRT, not for its philanthropic purposes, but to sell wealth replacement life insurance and as a way to take illiquid assets and swap them for proprietary investments. With the recent bear market, many of these product-oriented charitable trust sales have come back to haunt their promoters when they turned out to be short-term solutions to a marketing problem and created a lot of unhappy clients in the meantime.

Many advisors have been to marketing seminars and were issued financial hammers, and everything begins to look like nails. Unfortunately, quite a few insurance and mutual fund companies consistently promote the CRT, not for its philanthropic purposes, but to sell wealth replacement life insurance and as a way to take illiquid assets and swap them for proprietary investments. With the recent bear market, many of these product-oriented charitable trust sales have come back to haunt their promoters when they turned out to be short-term solutions to a marketing problem and created a lot of unhappy clients in the meantime.

In pitching the advantages of a CRT, many advisors stress capital gains avoidance. In reality, it is only capital gains deferral, and that depends as much on the replacement investments held by the CRT as to those that were initially placed in trust. Unfortunately, tax efficiency inside a CRT is not widely understood or even appreciated as an important factor of client satisfaction. Improperly managed, the CRT becomes an ordinary income pump instead of a more tax efficient means to distribute realized capital gains in an orderly way. If clients are not under some pressure to liquidate an entire portfolio of appreciated assets via the CRT, maybe they would be better off selling a few shares every year for income, and paying the temporarily reduced tax on those annual conversions. Thanks to JGTRRA 2003, capital gains tax liabilities make number crunching even more important since the lower 15% capital gain rate coupled with the new 15% dividend rate has changed the dynamics. If the client is primarily motivated to save tax, and not motivated by altruism, then why bother with a CRT? Advisors who remain focused on the clients needs will stay out of trouble and will gain more referrals from happy clients in the future

©2003 — Vaughn W. Henry

![]()

Vaughn W. Henry

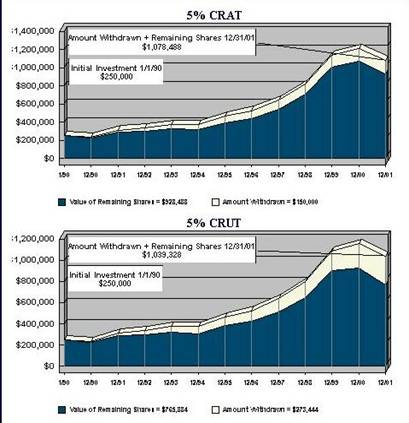

CONTACT US FOR A FREE PRELIMINARY CASE STUDY FOR YOUR OWN CRT SCENARIO or try your own at Donor Direct. Please note — there’s much more to estate and charitable planning than simply running software calculations, but it does give you a chance to see how the calculations affect some of the design considerations. This is not “do it yourself brain surgery”. When is a CRUT superior to a CRAT? Which type of CRT is best used with which assets? Although it may be counter-intuitive, sometimes a lower payout CRUT makes more sense and pays more total income to beneficiaries. Why? When to use a CLUT vs. CLAT and the traps in each lead trust. Which tools work best in which planning scenarios? Check with our office for solutions to this alphabet soup of planned giving tools.

CONTACT US FOR A FREE PRELIMINARY CASE STUDY FOR YOUR OWN CRT SCENARIO or try your own at Donor Direct. Please note — there’s much more to estate and charitable planning than simply running software calculations, but it does give you a chance to see how the calculations affect some of the design considerations. This is not “do it yourself brain surgery”. When is a CRUT superior to a CRAT? Which type of CRT is best used with which assets? Although it may be counter-intuitive, sometimes a lower payout CRUT makes more sense and pays more total income to beneficiaries. Why? When to use a CLUT vs. CLAT and the traps in each lead trust. Which tools work best in which planning scenarios? Check with our office for solutions to this alphabet soup of planned giving tools.

Speaker #1 met with elderly clients later and told them a CRT was the perfect tool for them.

Speaker #1 met with elderly clients later and told them a CRT was the perfect tool for them. The attorney

The attorney

This is a case study about a curmudgeon client best known for the attention he lavishes on the bottom line of his businesses.

This is a case study about a curmudgeon client best known for the attention he lavishes on the bottom line of his businesses. Jeff and his wife Ellyn have children from prior marriages, and each has divergent interests and planning goals.

Jeff and his wife Ellyn have children from prior marriages, and each has divergent interests and planning goals. We discussed his priorities in life and tried to foresee how his familys concerns would develop over the next ten or twenty years.

We discussed his priorities in life and tried to foresee how his familys concerns would develop over the next ten or twenty years.