Citibank Charitable Giving Survey – January 8, 2002

CPB Charitable Giving Survey

Final Report

January 8, 2002

Citigroup Private Bank -US Marketing

Prepared by:

Peg Dwan, VP, (212-559-7612)

Objective

To better understand HNW charitable giving needs and interests, so that CPB Philanthropic Advisement Service may better serve clients.

Information to be gathered includes —

Factors that impact charitable giving

% of income contributed, form of donation, distribution by type of charity, # of causes supported

Motivation for giving, selection criteria, evaluation of gift

Involvement of family in giving

Non-financial support

Demographics

Methodology

A one-page questionnaire was included in the November issue of “citigroup PB”. This issue focused on Philanthropy

Approximately 5,800 magazines were mailed to HNW clients and wealthy partners on November 16, 2001. Additional surveys were distributed at a HNW event in Charlottesville in October.

A postage paid return envelope was provided with the questionnaire; the clients were also given the option of returning their questionnaires by fax.

A preliminary report for Charlottesville responses was provided 11/19/01. This final report aggregates all responses. Differences at wealth level above and below $25MM are noted.

A response rate of 1.9% (112 responses) was achieved on the mail portion of the study; 23 were received from Charlottesville, for a total of 135. 64 clients were <$25MM in net worth; 55 were above and 11 were unknown.

Findings

Among the respondents ($3MM+ net worth), increase in wealth had most significant influence on giving; events of September 11 caused only 44% (31% of $25MM+) to increase or change focus of their giving; the economy has some influence, but is a determining factor for only 7%; and a change in tax law would not impact giving for more than half.

More than 60% of respondents donate over 5% of their income and support 5+ charities; top two charities are education (27%) and religion (20%). Cash and stock are the most mentioned type of donation.

Many respondents are committed, focused donors driven by personal reward; personal values (76%) and personal interest/ passion (67%) are the determining factors in identifying causes.

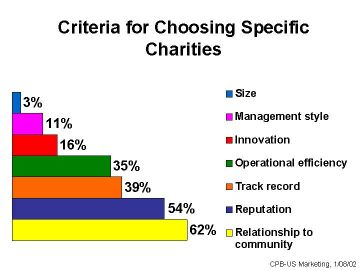

Personal involvement is key to choosing funding opportunities (78%); and the charity’s relationship to community (62%) and reputation (54%) are the main selection criteria; respondents do not evaluate the charity as a business/investment opportunity, but they do evaluate the impact of their gift.

Almost two thirds of respondents involve family in giving; one third have a family foundation (74% of $25MM+); and three quarters prefer to disclose their name when donating.

The majority of respondents volunteer time to charitable causes (77%); most devote 2+ hours a week; the most frequent activities noted were giving time (47%), serving on boards (38%) and consulting (33%).

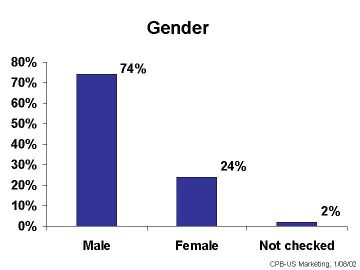

Three quarters of the respondents were male; the average age was 63; and 46% had total net worth of $25MM+.

Conclusion

An enormous amount of money is contributed to charity by individuals, a total of $152B in 2000. According to the IRS, the 2% of tax returns with $200M+ adjusted gross income donated $42B to charity in 1999; and 1998 Federal Reserve information suggests that % of income represented by contributions increased with net worth.

Charity is a very personal matter, even among the very wealthy. They are committed, focused donors; personal reward is the most important motivation for giving; personal values and personal interest the top two considerations in determining the cause and personal involvement the primary factor in choosing funding opportunities.

Wealth Most Significant Influence on Giving

Over the last 10 years, 86% of respondents had increased their charitable giving; of those who provided a reason, 79% cited increase in wealth or earnings.

The events of September 11 impacted giving for only 44% of respondents in total; 50% for those with net worth under $25MM and only 31% for those over $25MM.

68% noted that the economy had some influence; only 7% that it was a determining factor.

Giving would not change due to the new estate tax laws for 59% of respondents; 32% were unsure.

Many HNW donate a significant portion of income and support many charities

More than 60% of respondents (76% for $25MM+ net worth) typically donate over 5% of their income.

Cash or a combination of cash and stocks are the most often mentioned type of donation.

More than 60% support 10+ charities; 42% of the $25MM+ support 20+ charities.

The top two types of charities supported are education (26%) and religion (19%); 33% of the $25MM+ contribution goes to education vs. 20% for the <$25MM.

Many clients are committed, focused donors driven by personal reward

54% describe themselves as “committed, focused” donors, 23% of these as “leaders”

More than half are motivated by personal reward and a third each by life experience or obligation, which they explain to mean to “give back to society”.

Personal values and personal interest are the determining factors in identifying charities

A mix of local, national and international charities are selected for giving; $25MM+ are more likely to give to international charities (35% vs. 19% for <$25MM)

Personal involvement is key to choosing funding opportunities

The top 2 factors in choosing funding opportunities were personal involvement and research.

Specific charities are chosen for relationship to the community and reputation

Most clients do not evaluate the charity as a business or investment opportunity, but most do evaluate the impact of their gift.

Most involve family in giving; one third have a family foundation

Almost two thirds involve their family in giving; spouse and children are most often cited family members

About half have a foundation; 35% have a family foundation. For those with $25MM+, 80% have a private foundation; 74% family foundation.

Most prefer to disclose their name when giving; there is no difference by wealth level.

The majority of respondents volunteer time to charitable causes

More than three quarters of the respondents provide non-financial support to charitable organizations

Most contribute two or more hours per week, with 18% giving over 10 hours

Activities include volunteering time, board membership, consulting and mentoring.

The respondents were primarily male, somewhat older and just under half had $25MM.

Three quarters were male; only 40% of the Charlottesville respondents were male.

Two thirds of the respondents were over 55; mean age of 63; those with $25MM+ were slightly younger, 61 vs. 65 mean age; Charlottesville respondents were younger, mean age 53.

Fewer than half of the respondents had total net worth of $25MM+; unlike Charlottesville respondents, 75% of which had $25MM+ and 35% had $100MM+

Appendix A: Size, Source and Destination of Charitable Contributions

In 2000, more than $200B was contributed to charity, 75% of it by individuals. (Source: Giving USA)

About half the funds went to religion and education, similar to CPB survey, although reverse proportions.

According to the IRS, itemized income tax deductions for charity totaled $120B in 1999 ($42B from individuals with $200M adjusted gross income). Giving USA estimated an additional $24B from individuals not itemizing deductions.

Appendix B: Charitable Donations by Wealth Level

The higher the level of wealth, the larger the contributions. 27% of HHs with $100MM net worth gave $500M or more in 1998; almost 15% of their mean income. The $50-100MM wealth level gave 10% of their mean income.

Source: Federal Reserve 1998 Survey of Consumer Finances